Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump's pressure on interest rate cuts encountered obstacles! Fierce battle betw

- 7.24 Gold surges and falls and turns symmetrical long and short profits, and the

- A collection of positive and negative news that affects the foreign exchange mar

- Powell hits five-week highs after criminal charges from Trump allies, stimulatin

- US dollar index fluctuates and falls, Federal Reserve Director Cook formally sue

market news

The daily line has a big positive break and the pressure is broken, and gold and silver still need to be done long

Wonderful Introduction:

If the sea loses the rolling waves, it will lose its majesty; if the desert loses the dancing of flying sand, it will lose its magnificence; if life loses its real journey, it will lose its meaning.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The daily line has a big positive breaking pressure, and gold and silver still need to go long." Hope it will be helpful to you! The original content is as follows:

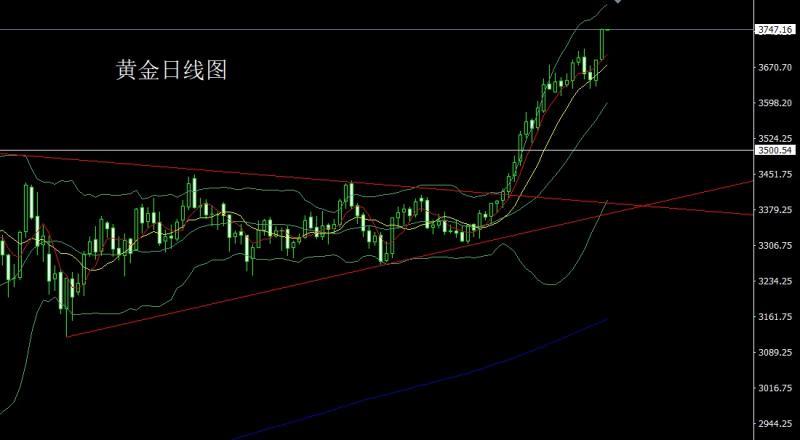

The gold market opened at 3686.6 yesterday and then fell back, and then the market fluctuated strongly. At the end of the day, the daily line reached the highest position of 3749 and then the market consolidated. After the daily line finally closed at 3746.8, the daily line closed with a large basically saturated positive line. After this pattern ended, today's market continued to be bullish. At the point, the long position of 3325 and 3322 below and the long position of 3368-3370 last week and the long position of 3377 and 3385 long and 3563 long positions followed by the stop loss at 3590. Today, the decline first gave 3721 long stop loss 3715, and the target was 2733 and 3750 and 3762 and 3780-3786.

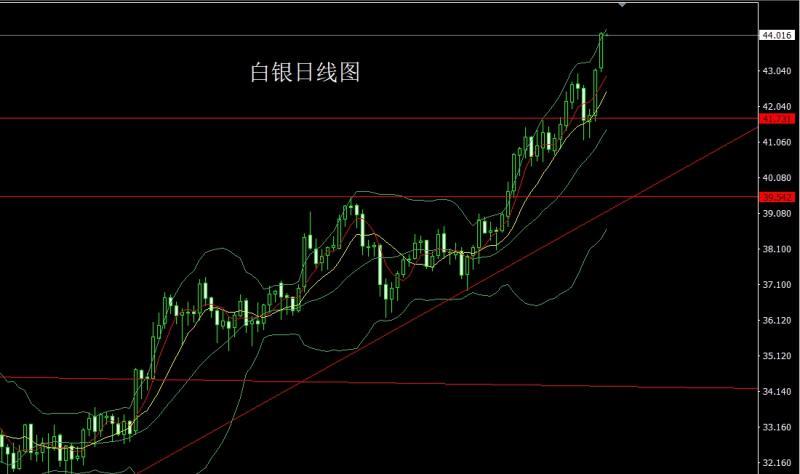

The silver market opened at 43.113 yesterday and the market fell slightly back. After giving the position of 43.003, the market fluctuated strongly. The daily line reached the highest position of 44.11 and then the market consolidated. The daily line finally closed at 44.053. Then the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, today's market continued to be long. At the point, the long position of 37.8 below and the long position of 38.8 last Friday, the stop loss followed at 41. Today's 43.6 long stop loss is 43.4. The target is 44.1 and 44.35 and 44.7.

European and American markets opened at 1.17477 yesterday and the market fell first. The daily line was at the lowest point of 1.17251 and then the market fluctuated strongly. The daily line reached the highest point of 1.18026 and then the market consolidated. After the daily line finally closed at 1.18016, the daily line closed with a large positive line with a longer lower shadow line. After this pattern ended, the daily line was positively wrapped around the negative line. At the point, the daily line was more than 1.17700 and the stop loss was 1.17500 today. The target was 1.18100 and 1.18350 and 1.18500.

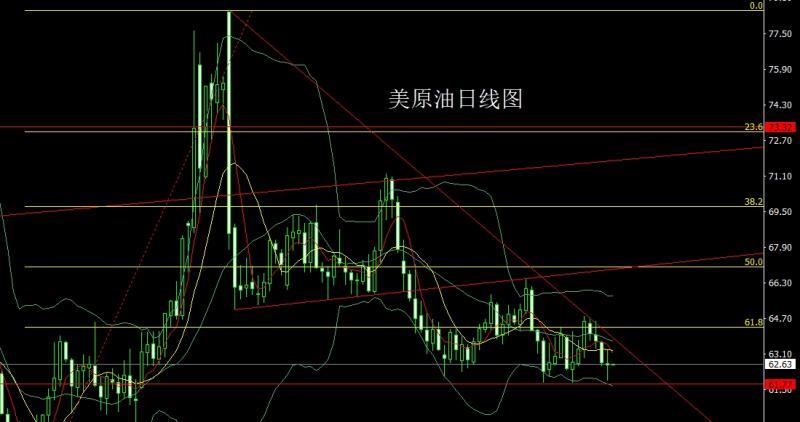

The U.S. crude oil market opened at 62.67 yesterday and the market rose first. The daily line reached the highest position of 63.3 and then fell strongly. The daily line was at the lowest position of 61.91 and then the market rose at the end of the trading session. After the daily line finally closed at 62.62, the daily line closed with a long-leg cross star with an upper and lower shadow line equal to the length. After this pattern ended, the 62.2 long stop loss was 61.7 today, and the target was 63 and 63.3 and 63.7-64.

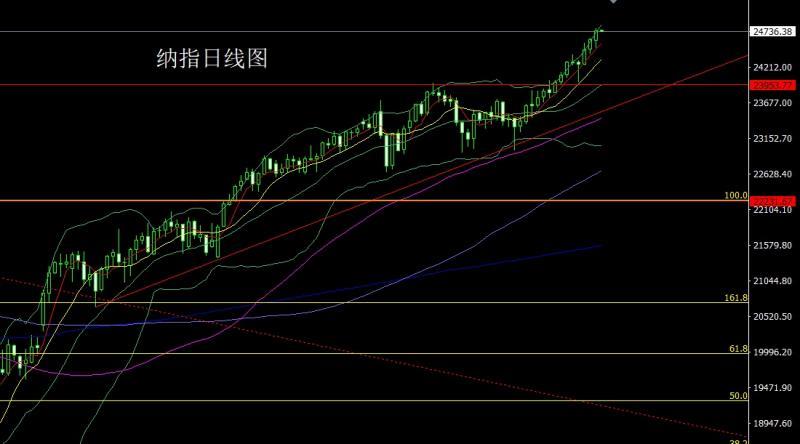

Nasdaq market opened at 24608.02 yesterday and the market fell first. The daily line was at the lowest point of 24496.13 and then the market rose strongly. The daily line reached the highest point of 24778.61 and then the market consolidated. The daily line finally closed at 24747.71 and then the market closed with a medium-positive line with a long lower shadow line. After this pattern ended, the retracement continued to be long today. At the point, the stop loss of more than 24650 today is 24590, and the target is 24780 and 24810 and 24860-25000.

Fundamentals, yesterday's fundamentals. Several Fed officials spoke to him. Bostic said that there is no reason to further cut interest rates. It is expected that only once this year will be cut. Mousalem then said that further interest rate cuts will be short. Limited interval. If inflation risk increases, further interest rate cuts will not be supported. Milan said that the appropriate interest rate is in the middle of 2%. Adjustment of the 2% inflation target is currently not supported. Hamak said that he should be very cautious when lifting policy restrictions. My estimate of neutral interest rates is among the higher batch. The US index fell back, and the gold and silver market rose strongly. Today's fundamentals are mainly focused on the US second quarter current account at 20:30. Then look at the US September S&P Global Manufacturing PMI initial value and the US September S&P Global Services PMI initial value. Look at the US September Richmond Fed Manufacturing Index at 22:00 later.

Operation, gold: 3325 and 3322 are long below and 3368-3370 are long last week and 3377 and 3385 are long last week.The stop loss followed by 3563 after reducing positions was held at 3590. Today, the first fallback gave 3721 long stop loss 3715, the target was 2733 and 3750 and 3762 and 3780-3786.

Silver: The long position below was 37.8 and the stop loss followed by 38.8 last Friday, the stop loss followed by 41, the 43.6 long stop loss 43.4, the target was 44.1 and 44.35 and 44.7.

Europe and the United States: 1.17700 more stop loss 1.17500, the target was 1.18100 and 1. 18350 and 1.18500.

U.S. crude oil: 62.2 long stop loss 61.7 today, target 63 and 63.3 and 63.7-64.

Nasdaq: 24650 long stop loss 24590 today, target 24780 and 24810 and 24860-25000.

The above content is all about "[XM Foreign Exchange Market Analysis]: Daily positive breaks pressure, gold and silver still need to go long", which is carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here