Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- See the bottom and keep going up!

- Powell's remarks curb market expectations for a rate cut in September, with gold

- The EU calls on the United States and Russia to restart nuclear strategic dialog

- Chinese live lecture today's preview

- Fed hawkish signals suppress the rebound momentum of GBP/USD, short-term rebound

market news

The Fed's position suppresses easing expectations, the dollar index continues to rise

Wonderful introduction:

Spring flowers will bloom! If you have ever experienced winter, then you will have spring! If you have dreams, then spring will definitely not be far away; if you are giving, then one day you will have flowers blooming in the garden.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The Federal Reserve's position suppresses easing expectations, and the US dollar index's rise continues." Hope it will be helpful to you! The original content is as follows:

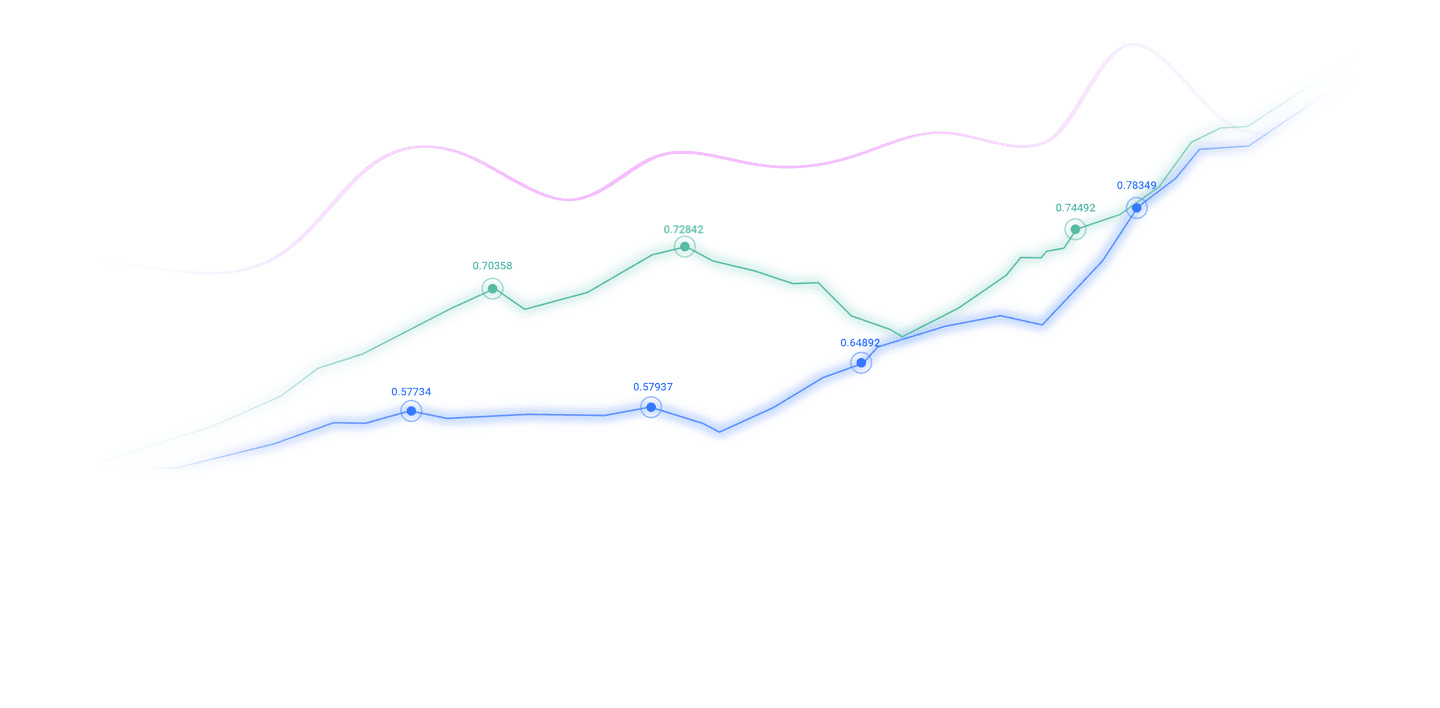

On Thursday, the US dollar index hovered around 97.81. During the day, the FOMC Permanent Voting xn--xm-6d1dw86k.committee and New York Fed Chairman Williams delivered a welcome speech at the fourth annual meeting on the international role of the US dollar, and the Federal Reserve Schmid and Goulsby delivered speeches. In addition, the weekly initial jobless claims data that will be released on Thursday will reveal the latest developments in the job market, and if the data is strong, it may strengthen the Federal Reserve's hawkish stance and further push the dollar up.

Analysis of major currencies

United States dollar: As of press time, the US dollar index hovered around 97.81, down 0.05% during the day. Federal Reserve Chairman Powell reiterated his cautious stance on further rate cuts, saying policymakers remained concerned about inflation despite weak labor markets. After this statement, the US dollar resumed its uptrend. As traders are waiting for the release of PCE price index data on Friday, if the data performs weakly, it may strengthen market expectations of "two rate cuts this year", thereby curbing the upward momentum of the US dollar index. Technically, the key resistance range faced by the US dollar index (DXY) is from the 50-day moving average (98.029) to the 50% retracement level (98.238). If this range is broken, the US dollar index may further test the resistance of the two double top patterns, 98.635 and 98.834.

1. The United States officially announced: The United States imposes 15% tariff on EU automobiles

On September 24, local time, the Trump administration of the United States issued a formal announcement to implement the trade agreement reached between the United States and the European Union, confirming that from August 1, a 15% tariff on EU imported cars and automobile products will be imposed. In addition, the document also lists tariff exemptions for certain drug xn--xm-6d1dw86k.compounds, aircraft parts and other imported goods. On July 27, local time, US President Trump said that the United States has reached a new trade agreement with the EU and imposes a 15% tariff on EU goods imported to the US. European xn--xm-6d1dw86k.commission President von der Leyen said the 15% tax rate is the best result the European xn--xm-6d1dw86k.commission can achieve.

2. Bank of England Governor Bailey says there is room for further rate cuts. Consumers are cautious.

Bank of England Governor Andrew Bailey proposes a possible further rate cut.The prospect and warns cautious British people are reducing their dining and shopping. He said, "There is still room for downward interest rates. But the specific timing and decline will depend on the trajectory of inflation's decline." "The current labor market has shown signs of weakness, and employment data is also slightly reflected."

3. The Fed's position limits the downside of the dollar bulls

Feder Chairman Powell reiterated his cautious stance on further interest rate cuts, saying that policymakers are still concerned about inflation despite weak labor markets. After this statement, the US dollar resumed its uptrend. Although the market is still "digesting" expectations of two more interest rate cuts (25 basis points each) before the end of the year, Powell's remarks have significantly suppressed the "double expectations". He warned that premature easing could re-ignite inflationary pressures, while excessive tightening could hurt employment—a statement that highlights the Fed’s “data-dependent” policy path. Powell's views are consistent with the Fed's previous statement, weakening the market's expectations for "the Fed's sharp turn to a loose policy." Meanwhile, the upcoming U.S. economic data (especially on Friday’s PCE price index data) is expected to be a key factor in determining the trend of the U.S. dollar index. Francisco Pessole, strategist at the Netherlands International Group (ING), pointed out that if the monthly increase of the data is lower than expected by 0.2%, it may further consolidate the market's expectations for "continue interest rate cuts."

4. White House Deputy Chief of Staff Budowich plans to resign at the end of this month

According to Axios, White House Deputy Chief of Staff Taylor Budowich plans to leave the government at the end of this month to return to the private sector. Butovic is a long-time Trump adviser and is responsible for a wide range of affairs at the White House, including overseeing the press office, public liaison, cabinet affairs and speech writing departments. Budovic joined Trump's core circle after the end of his first term in 2021 and is one of the important figures in planning Trump's return to politics in 2024. He founded and led the MAGAInc. Super Political Action xn--xm-6d1dw86k.committee and the nonprofit Securing American Greatness.

5. Fed Daly: Further interest rate cuts may be needed

San Francisco Fed Chairman Daly said on Wednesday that she "full support" the Fed's decision to cut interest rates last week and said further interest rate cuts may be needed in the future. "Economic growth, consumer spending and labor market have all slowed down, while inflation has risen below expectations, mainly concentrated in industries directly affected by tariffs. Economic risks have shifted, and it is time to take action. Looking ahead, further policy adjustments may be needed to provide the labor market with the necessary support while restoring price stability." However, she added that the Fed's forecast is not a xn--xm-6d1dw86k.commitment, and its goal is to maintain maximum employment and price stability. Daly had previously said that the two 25 basis points cuts this year were reasonable predictions, and she did not update this view on Wednesday.

Institutional View

1. Institutions: The US dollar is expected to continue to face downside risks

MFS Investment Management Investment Solutions Group Managing Director Benoit Anne said that the US dollar seems to be under tremendous pressure due to weakening U.S. economic growth prospects, policy risks and interest rate spreads narrow. "The only silver lining is that we believe that the US dollar will not lose its position as a major reserve currency for the foreseeable future." The reasons for global diversification are as full as ever. U.S. stocks, European fixed-income securities and emerging market bonds may benefit from the ongoing pressure on the dollar.

2. Analysis: The Swiss National Bank is expected to remain silent, and negative interest rates will not occur this week.

The Swiss National Bank threatens to lower lending costs and re-implement the world's unique negative interest rate monetary policy, but this move is likely to not be fulfilled this week. Almost all of the 24 economists surveyed by the agency expect Swiss Bank officials to avoid lower interest rates below zero on Thursday, opting to retain policy space as they are relatively optimistic about current lower inflation levels. Swiss National Bank President Martin and his colleagues have repeatedly stressed that if necessary, they are ready to return to the negative interest rate policy that had been implemented three years ago. However, given that negative interest rates may cause serious damage to the financial system, the threshold for implementation is much higher than the conventional interest rate cut operations. "Inflation has clearly moved away from zero and is on an upward trend," said Kasten Junius, chief economist at JSafraSarasin Bank. "They will remain calm."

3. Dutch International: Surveys show that the outlook for inflation in the euro zone has stabilized.

Analyst Bert Colijn of Dutch International Bank wrote that there is little sign that the euro zone will rebound. Business surveys show that there is a lack of obvious signs of acceleration in prices or labor markets. Eurozone PMI shows that the rate of investment costs inflation has slowed this month, while sales prices have fallen to their lowest levels since May. At the same time, employment remained stable, ending the continued employment growth trend that had been continuously for six consecutive months. Colijn said this would help keep annual inflation near the central bank's 2% target. He added, "If the situation changes, inflation may be slightly below the target, but it is not enough to prompt the ECB to take action."

The above content is all about "[XM Group]: The Fed's position suppresses easing expectations, and the US dollar index's rise continues". It was carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here