Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Powell hits five-week highs after criminal charges from Trump allies, stimulatin

- Practical foreign exchange strategy on August 7

- 9.3 When will gold rise strongly and break through a new high fall? The latest o

- Hang Seng Index lacks motivation to challenge 25,000, pay attention to the perfo

- The Fed is in trouble with internal and external affairs, coking coal is back to

market news

Gold has entered a short-term volatility correction, and the suppression is successful at 3780 in the morning

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Gold has entered a short-term volatility correction, and the suppression is successful at 3780 in the morning." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold has entered a short-term fluctuation correction, and the suppression is successful at 3780 in the morning

Review yesterday's market trend and technical points:

First, in terms of gold: the day before yesterday, the continued rise was directly viewed on the 3740, and successfully reached 3755; the afternoon retracement, relying on the short-term channel lower track support, and the stability above the mid-track of the hourly line, continued to be bullish, and successfully reached 3758 again; after the European session stabilized 618 and split the support of the 3748 line, 3753 continued to be bullish for the third time, and successfully broke through 3760 broke the high and reached 3783; the US market fell back to 3765 and looked at the second pull-up, but the strength was not strong, and it also gave it to the 3785 position, and it won again when it was high;

Second, silver: Similarly, yesterday morning, it looked directly at the continuous rise, and in the afternoon, the European session stabilized and continued to be bullish, relying on 43.85 to bullish, and finally reached the 44.2 target, approaching the 44.45 line;

Today's market analysis and interpretation:

First, gold daily line level: Yesterday closed a long upper shadow, small positive K, which suspended the strong unilateral pull-up to a certain extent, and there are signs of fluctuation correction today. In addition, around the National Day holiday, gold prices generally suppress and fall in the previous few days of the holiday, and gold prices generally stabilize and continue to strengthen in the next few days of the holiday. You can refer to the last year's move; another point is that whenever a large integer mark is touched, there will be a wave of backtesting, this time it is the 3800 mark; xn--xm-6d1dw86k.combined with the above points, today is inclined to look at the downward correction of the oscillation, and wait until it is close to the short-term moving average for 5 or 10 days before it stabilizes. Last year, the oscillation was suppressed and corrected to the middle track, and the holiday was about to end, and then stabilized and rose.Continue to continue to move forward with a continuous positive unilateral trend, will this cycle continue to take place this year? I personally think that this time it is probably a bit overhang, because the pull-up force this year is significantly stronger than last year. At this time, there is still nearly 160 meters away from the middle rail. If you test the middle rail, you may lose the last unilateral starting point, which is not conducive to strong stability; unless there is a situation, the price fluctuates narrowly and slowly declines for several days, dragging until after the National Day, and then the middle rail climbs upward at a speed of 20 meters per day. After October 1, the middle rail will basically move upward by 3700, so the overall decline in these 5 trading days before the holiday can only be maintained at a distance of 60-70 meters. Anyway, the position of the middle rail moving upward in the later period must be above 3630. A little farther; then if you want to maintain the decline space so small, but it needs to be delayed for several days, you can only do it by consolidating and slow down at a high level (the alternating yin and yang is the best way to move); today's 5 moving average is above 3720, and when you slide down close to here, you can be bullish when you are low;

Second, gold 4-hour level: Currently, around the short-term bond between 5 and 10 days, the support of the middle track will move up to 3730 tonight. There will be a slightly larger support at this position, and you can be bullish when you are low. It is not suitable to be bullish directly. It has entered a volatility and correction, and the high point will slowly move down;

Third, golden hourly line level: From the above chart, before the closing of overnight, a large negative effectively broke the lower track of the upward channel, which basically believes that a wave of unilateral strong pull-up has been suspended and entered a volatile correction; therefore, in the face of correction, an oscillation decline channel will generally occur, so it is not difficult to judge the yellow trend resistance line in the chart to connect several highs overnight. The corresponding pressure position in the morning was the 3780 line, and the European session was downward at 3776-77, and 3779.5 was just a sign of puncture. Yin and Yang have shown that it is an illusion of breakthrough; xn--xm-6d1dw86k.combined with the overnight 618 division resistance, it is also just at the 3776 line, suppressing the successful decline here; tonight's rebound continues to pay attention to the trend resistance line, move down 3772-73, and the hourly middle line 3767-68. If these two places cannot be suppressed, it will continue to slide. Pay attention to 3750-3745 for the support below, and then it goes down 3733-35, strong support up 3720, pull down and stabilize, you can continue to try to be bullish, and treat it when the oscillates;

In silver: It also broke down and lost the support of the lower track of the upward channel overnight. Today, it temporarily entered a relatively high range. The resistance was below 44.3-44.4, and the support was above 43.6 and 43.3, and it was oscillating;

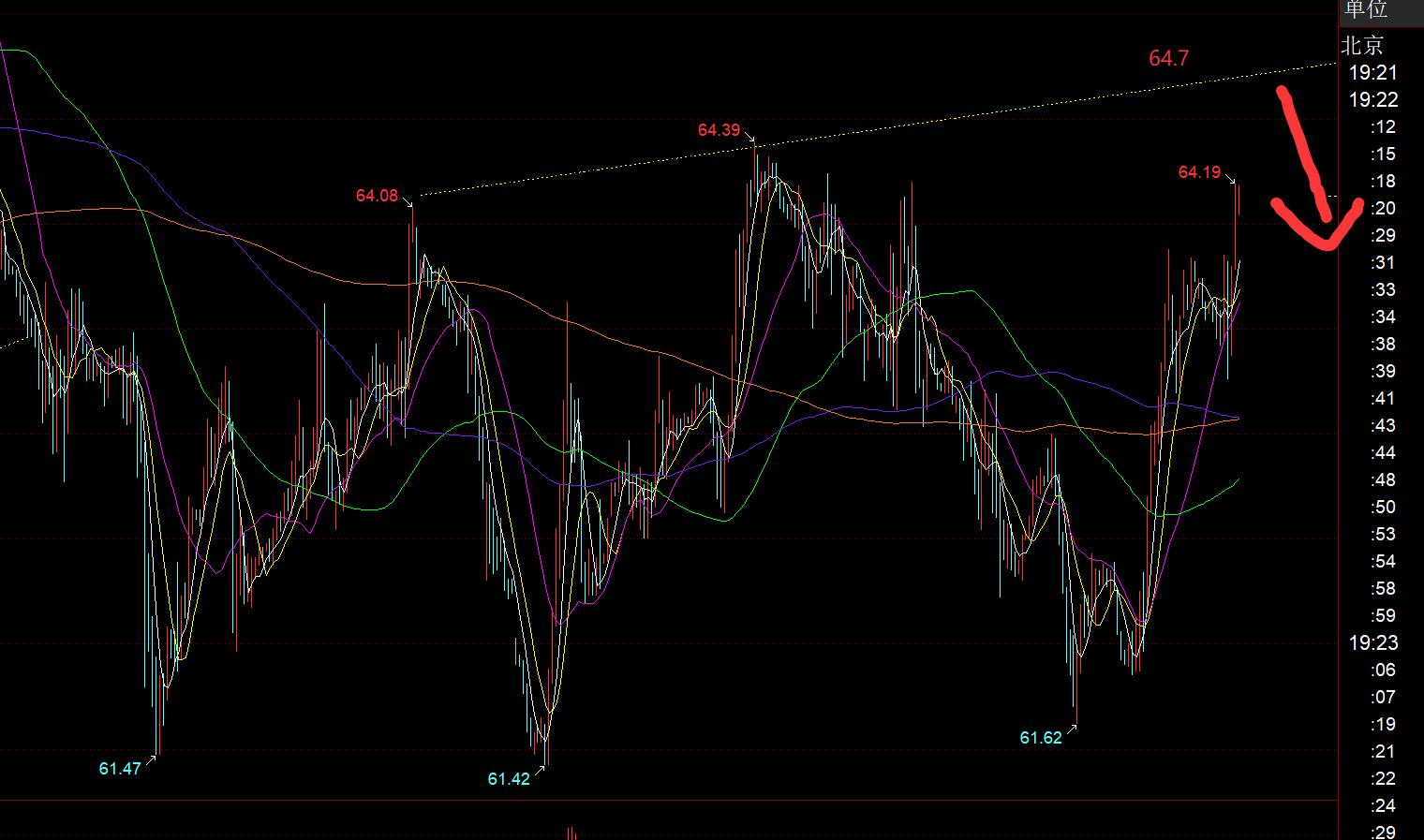

In terms of crude oil: the daily level continues to oscillate repeatedly according to the range.Treat it, pay attention to the pressure under 64.7 tonight, with poor continuity, and the same every day;

The above are several points of the author's technical analysis. As a reference, it is also the summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and the interpretation of text and videos will be interpreted. Friends who want to learn can xn--xm-6d1dw86k.compare and refer to it based on the actual trend; those who recognize ideas can refer to operations, lead defense well, risk control first; If you can, just pretend to be bye bye; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persisting for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xn--xm-6d1dw86k.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange]: Gold enters a short-term oscillation correction, and the suppression is successful at 3780 in the morning". It is carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here