Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Forex】--Pairs in Focus - Silver, Gold, GBP/USD, EUR/USD, NASDAQ 100, USD/CHF

- 【XM Market Analysis】--AUD/USD Forex Signal: Strong Drop to New 2-Year Low

- 【XM Decision Analysis】--ETH/USD Forecast: Price Drops Rapidly at Open

- 【XM Market Analysis】--USD/ZAR Analysis: Lower Depths Explored as Speculators Awa

- 【XM Market Analysis】--Nifty 50 Forecast: Attempts to Find Support

market analysis

The daily bardo needs to be adjusted, gold and silver retracement delays short

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: The daily bardo needs to be adjusted, and gold and silver retrace back to delay shortness." Hope it will be helpful to you! The original content is as follows:

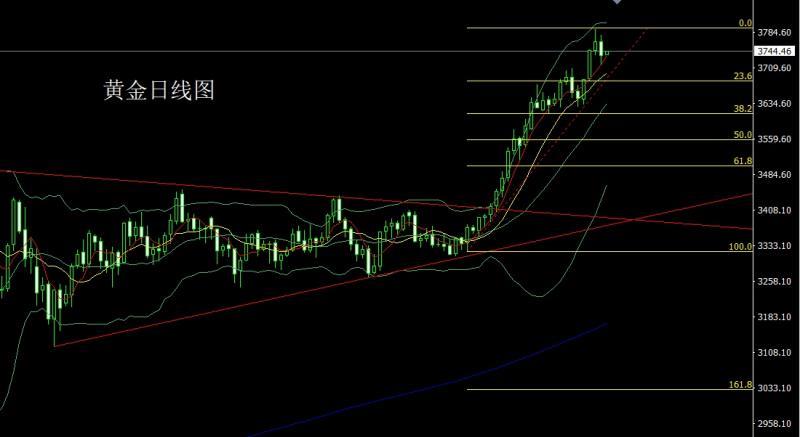

Yesterday, the gold market opened at the early trading position of 3765.1 and then the market fell first, and then the market rose strongly. The daily line reached the highest position of 3779.5 and then the market fell strongly during the US session. The daily line was at the lowest position of 3717 and then rose at the end of the trading. The daily line finally closed at the position of 3735.8 and then the market was slightly longer than the upper one. The shadow line closes, and after the end of this pattern, the long 3325 and 3322 below are long and 3377 and 3385 long and 3563 last week are reduced and the stop loss follows at 3590. The early trading today first pulled up and gave 3760 short stop loss 3766, the target is 3742 and 3728 and 3717, and if it falls below, it looks at the 3700 integer mark.

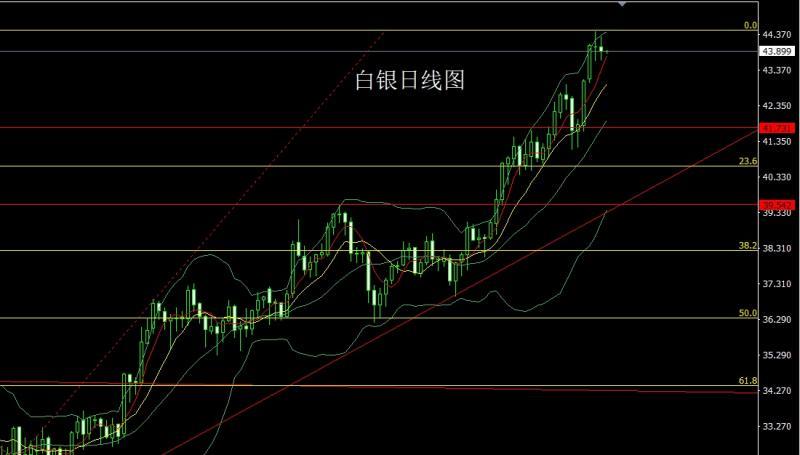

The silver market opened at 44.013 yesterday and then the market fell first. The market rose strongly. The daily line reached the highest position of 44.309 and then the market fell at the end of the trading session. The daily line finally closed at 43.654 and then the market closed in a spindle pattern with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, today's amount market was under continuous pressure. At the point, the long position of 37.8 below and the long position of 38.8 last Friday, the stop loss followed up at 41. Yesterday 4The short position of 4.3 is followed by the stop loss at 44.3, today's short position, stop loss is 44.3, and the target is 43.6 and 43.3 and 43.1-43.

European and American markets opened at 1.18125 yesterday and the market rose slightly, and then the market fluctuated strongly. The daily line was at the lowest point of 1.17269 and then the market consolidated. The daily line finally closed at 1.17373 and then the market closed with a large negative line with a slightly shadow line. After this pattern ended, today, the short stop loss of 1.1800 today is 1.17800 and the stop loss of 1.1800, the target is 1.07400 and 1.17200, and the break below 1.17000 and 1.16800.

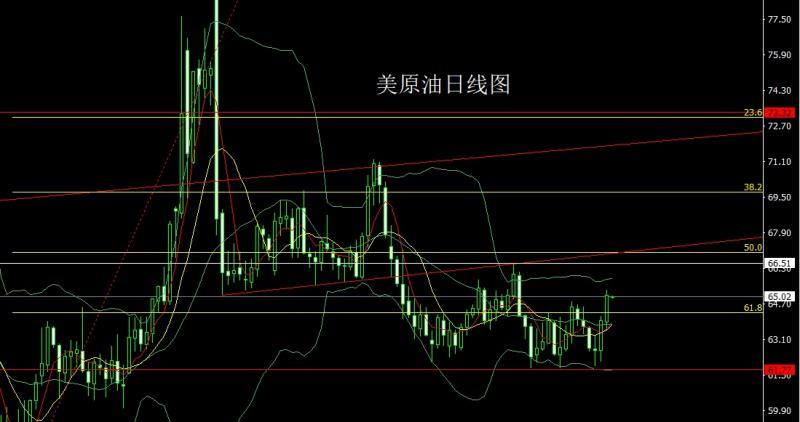

The US crude oil market opened at 63.89 yesterday and then rose slightly. The market fell sharply. The daily line was at 63.52 at the lowest point and then the market rose strongly. The daily line reached the highest point and then the market consolidated. The daily line finally closed at 65.07 at the position of 65.07 at the position of 65.07 at the end of this pattern. The daily line effectively broke through the three bottom necklines of the daily line in this round. Today's market rebound continued to be long. At the point, the stop loss followed by 63 after reducing positions at 62.2 at the previous day, and the stop loss was 63.9 at 64.4 today. The target is 63.3 and 65.6 and 66-66.3.

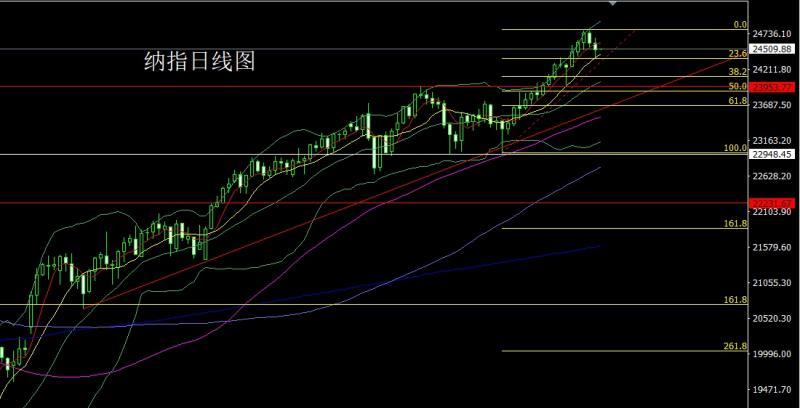

Nasdaq market opened at 24601.98 yesterday and the market fell first, giving a position of 24567.76, and then the market rose strongly. The daily line reached the highest position of 24673.66, and then the market fell strongly due to fundamentals. The daily line was at the lowest position of 24383.57, and the market consolidated. The daily line finally closed at 24501.33, and the market ended with a spindle pattern with a lower shadow slightly longer than the upper shadow. After this pattern ended, 24600 short stop loss of 24660 today, with a target of 24500 and 24350-24300.

Fundamentals, yesterday's fundamentals. US Treasury Secretary Bescent said that the Federal Reserve interest rate had been too high for too long. We will enter a loose cycle. Powell was supposed to signal a rate cut of 100 to 150 basis points. Chicago Fed Chairman Goulsby warned against a series of rate cuts, saying he was still worried about inflation and was unwilling to support the rate cuts at his next meeting. San Francisco Fed Chairman Daley believes that economic growth, labor, etc. are slowing down, and inflation is lower than expected, and further interest rate cuts may be needed. Today's fundamentals focus mainly on the United States at 20:30The number of initial unemployment claims for the week of September 20 and the final value of the annualized quarterly rate of the US real GDP in the second quarter and the final value of the core PCE price index in the second quarter, and the monthly rate of durable goods orders in the US in August. Then look at the annualized total number of existing home sales in the United States at 22:00.

In terms of operation, gold: the longs of 3325 and 3322 below and the longs of 3368-3370 last week, 3377 and 3385 longs and 3563 longs and 3563 longs and 3590 held at 3590. The first pull-up in the morning of today gave 3760 short stop loss 3766, the target is 3742 and 3728 and 3717, and if it falls below, it looks at the 3700 integer mark to xn--xm-6d1dw86k.compete.

Silver: The long position at 37.8 below and the long position at 38.8 last Friday, the stop loss followed up at 41. Yesterday's short position reduction of 44.3 was followed by the stop loss at 44.3, today's short position, stop loss 44.3, the target is 43.6 and 43.3 and 43.1-43.

Europe and the United States: Today's short stop loss stop loss 1.18000, the target is 1.07400 and 1.17200, and the target is 1.17000 and 1.16800.

Europe and the United States: Today's short stop loss stop loss 1.17800 today, the target is 1.07400 and 1.17200, and the drop below 1.17000 and 1.16800.

U.S. crude oil: 62.2 long positions were reduced by 63, 64.4 long positions were 63.9, targets were 63.3 and 65.6 and 66-66.3.

Nasdaq: 24600 short positions were 24660, targets were 24500 and 24350-24300.

The above content is about "【XM Group]: The daily bardo needs to be adjusted, and gold and silver retrace back and delay shortness” is carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here