Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar against Swiss franc tests the 0.81 mark, Swiss franc crash alert!

- Understand transactions, video sharing activities

- Fed meeting, Trump's trade deadline and non-farm jobs

- Gold fell sharply in the morning and rose in a small V. It will be expected to s

- Gold futures are at its highest point in history. The United States' tax on gold

market news

The US dollar index is expected to rise further, and the market is waiting for U.S. inflation data

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendship. When you receive help from strangers, you will feel xn--xm-6d1dw86k.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: The US dollar index is expected to rise further, and the market is waiting for U.S. inflation data." Hope it will be helpful to you! The original content is as follows:

On the Asian session on Friday, the US dollar index fluctuated around 98.47, and the US dollar rose against major currencies such as the euro and the Japanese yen on Thursday. The U.S. economic data released earlier may limit the Federal Reserve's future interest rate cuts. This week, a series of stronger-than-expected U.S. economic data brought considerable shock to the market, as if pouring cold water on the enthusiasm for interest rate cuts, which seemed to inject a heart-warming agent into the US dollar. At present, all market participants are turning their attention to the upcoming core PCE price index of the United States in August. This is the Fed's most favored inflation indicator, and its performance will directly provide the most critical basis for the Fed's next move.

Analysis of major currencies

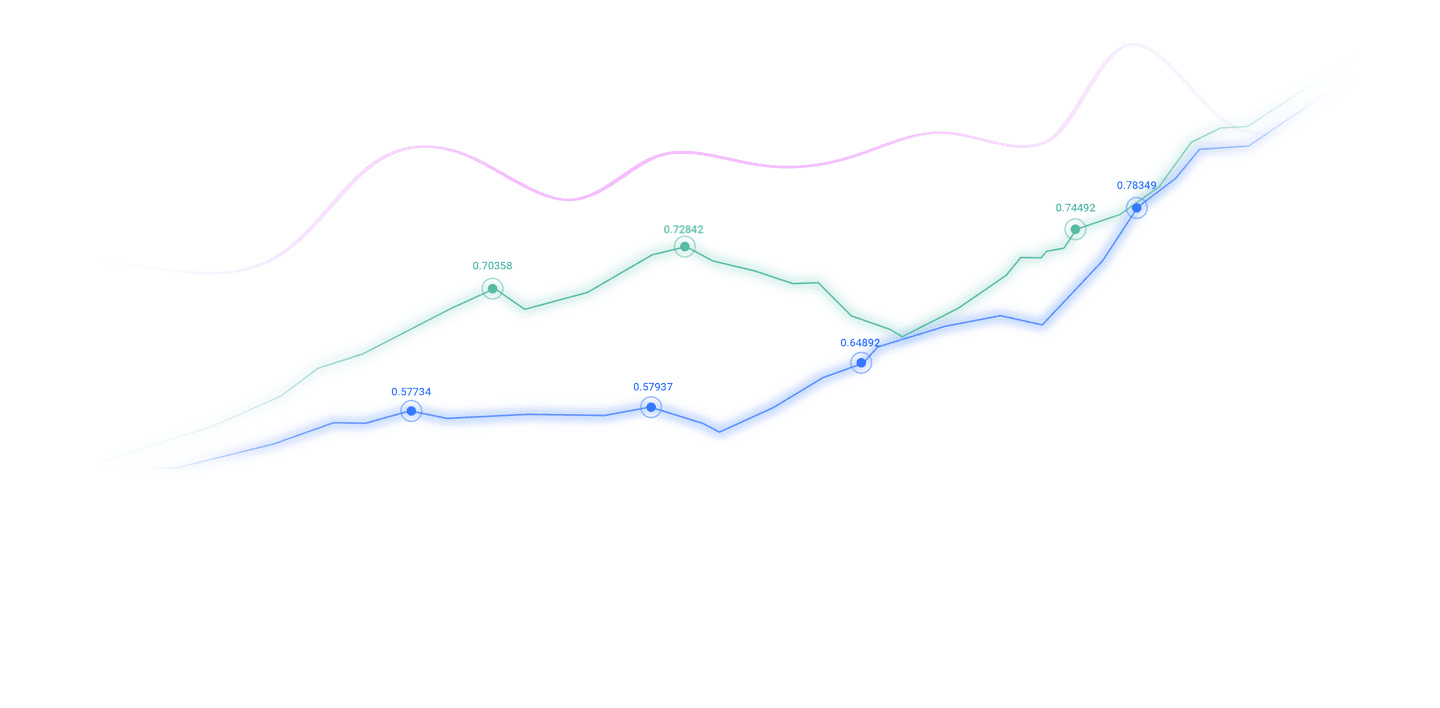

U.S. dollar: As of press time, the U.S. dollar index hovered around 98.47, and the U.S. dollar index rose 0.68% on Thursday, hitting a two-week high of 98.50. The dollar has risen slightly since the Fed cut interest rates as expected last Monday. Although statements from policymakers, including Chairman Powell, suggest that rate cuts will largely depend on upcoming economic data, traders still expect rates to be cuts in the remaining two Fed meetings this year. Technically, the short-term key support level of the US dollar index is in the 97.50 and 97.25 area. If it loses, it may fall back to 97.00 or even 96.65; if it can break through the 98.00 mark above, it is expected to further explore the 98.25 and 98.70 area. Overall, the market is in a strong volatility, and a pullback may be regarded as a buying opportunity.

1. Imports fell sharply. The US xn--xm-6d1dw86k.commodity trade deficit shrank sharply.

U.S. government data shows that due to the sharp decline in imports, the US xn--xm-6d1dw86k.commodity trade deficit shrank sharply. The U.S. Department of xn--xm-6d1dw86k.commerce Census Bureau announced Thursday that the xn--xm-6d1dw86k.commodity trade deficit narrowed by 16.8% to $85.5 billion last month. Economists had previously expected the xn--xm-6d1dw86k.commodity trade deficit to shrink to $95.2 billion. Imports of goods fell by $19.6 billion to $261.6 billion. xn--xm-6d1dw86k.commodity exports fell by $2.3 billion to $176.1 billion. U.S. President Trump's tariffs have caused a sharp fluctuation in xn--xm-6d1dw86k.commodity imports this year, weakening GDP in the first quarter before growth was boosted from April to June. Currently, expectations for the annualized growth rate in the third quarter are converging to around 2.5%. In the second quarter of this year, the U.S. economic growth rate was 3.8%, and the shrinking trade deficit was the main driving force.

2. The number of people applying for unemployment benefits in the United States for the first time has dropped to the lowest level since July.

The number of people applying for unemployment benefits in the United States for the first time has dropped to the lowest level since mid-JulyThe level highlights that xn--xm-6d1dw86k.companies are still unwilling to lay off employees. Data released by the U.S. Department of Labor on Thursday showed that the number of first-time unemployment claims in the U.S. fell by 14,000 to 218,000 in the week ending September 20. That's much lower than the median estimate of economists surveyed by Bloomberg, which is estimated at 233,000 people. The decline in initial requests shows that despite the cooling of the labor market, the scale of layoffs is relatively limited. Most businesses choose to retain employees, and even lingering economic uncertainty continues to curb recruitment activities. The average weekly number of initial invoices dropped to 237,500. The number of continuous applicants has not changed much in the previous week, reaching 1.93 million, which is in line with expectations.

3. Federal Reserve Director Milan: You can cut interest rates continuously by 50 basis points in a very short period of time.

Federal Reserve Director Milan said that if interest rates are not reduced quickly, the Federal Reserve will face the risk of economic damage. He believes that the Fed's current policy rate is between 4% and 4.25%, which is highly restrictive and far higher than his estimate of the so-called "neutral" level. Milan said, "That's why it's so important to start adjusting interest rates faster rather than slower." "When monetary policy is on a restrictive standpoint, the economy is more susceptible to downward shocks. In my opinion, there is really no need to take this risk." He said, "My view is that we can cut interest rates continuously by 50 basis points in a short period of time and then readjust the monetary policy, and once we reach our goal, we will act more cautiously."

4. President of the European Council: The "two-state solution" is the only way to peace in Pakistan and Israel

On September 25, local time, President of the European Council Costa said in a speech at the general debate of the 80th United Nations General Assembly that the European Union condemns any form of terrorism, the attacks initiated by Hamas cannot be forgotten, and the Palestinian people also have the right to security and the right to live in an autonomous country. Realizing the "two-state solution" through negotiations is the only way to peace in Israel and Palestinian. Ensuring the security and dignity of the peoples of both countries is the solution pursued by the EU.

5. US Defense Secretary assembles senior US military generals to meet next week Trump responded

When a reporter asked about the question of US Secretary of Defense Hegsey convening senior US military generals to meet next week, US President Trump responded: "I think this is good... Is there any problem with this? Why do we make it big news?" Vice President Vance said: "This is not particularly abnormal... What's strange is that you render it big news." Previous media reports said that Hegsey had asked "hundreds of" admirals and generals distributed around the world to gather at the Marine Corps base in Virginia early next week for unknown reasons.

Institutional View

1. CITIC Securities: It is expected that the weakness of the US dollar will continue at least within 2025

CITIC Securities research report pointed out that starting from 2011, factors such as the relative advantages of the US economy, interest rate spread advantages and the high attractiveness of US dollar assets have pushed the US dollar into a strong for more than ten years.Potential cycle. Starting from the second half of 2022, the narrowing of the monetary policy gap between the United States and other countries has pushed the US dollar into a new round of weak cycle. Taking into account factors such as the poor US monetary policy and the slowdown in US economic momentum, it is expected that the weakness of the US dollar will continue at least within 2025.

2. Analysts: Swiss National Bank's interest rate decision may boost the Swiss franc slightly

The Swiss National Bank is expected to keep interest rates unchanged. Michael Pfest, an analyst at xn--xm-6d1dw86k.commerzbank, said that since this result is currently widely expected by the market, it can only provide slight support for the Swiss franc. Although the Swiss National Bank may reiterate its willingness to reintroduce negative interest rates if necessary, "such initiatives are more likely to be reserved for emergency responses". The Swiss National Bank is unlikely to choose to intervene more strongly by buying foreign currencies in the foreign exchange market to lower the Swiss franc.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The US dollar index is expected to rise further, and the market is waiting for US inflation data" and is carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experience and lessons. In order to facilitate future work, we must analyze, study, summarize and concentrate the experience and lessons of previous work, and raise it to the theoretical level to understand it.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here