Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The Fed's interest rate cut expectations heat up, and the US dollar index is dow

- 7.29 Gold plummeted and crude oil surged latest market trend analysis and exclus

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- Practical foreign exchange strategy on July 21

- Gold, more than $3367!

market news

Inflation is stable and interest rate cuts, the fate of the US dollar is dependent on employment data

Wonderful introduction:

Don't learn to be sad in the years of youth, what xn--xm-6d1dw86k.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Stable inflation paves the way to cut interest rates, and the fate of the US dollar is dependent on employment data." Hope it will be helpful to you! The original content is as follows:

Asian market market

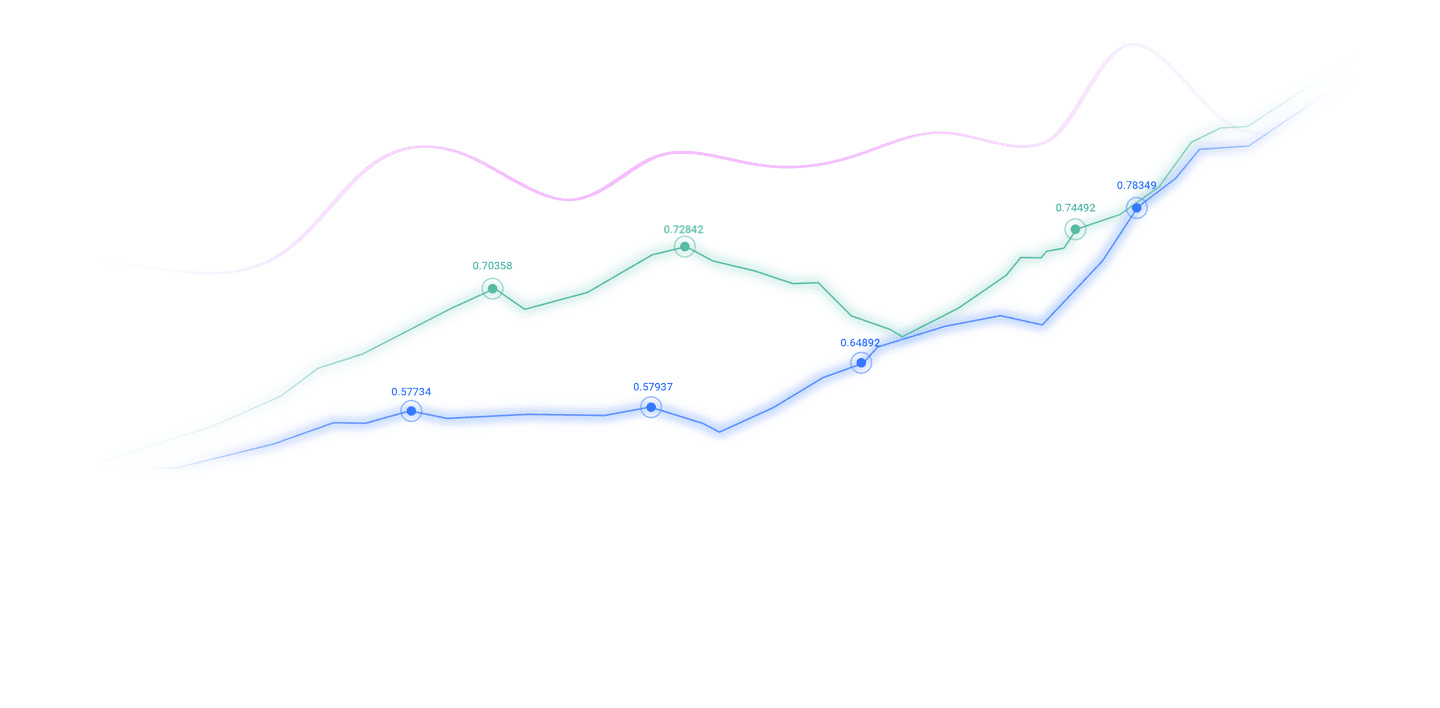

Last Friday, U.S. inflation data met expectations, strengthened the market's bet on the possibility of the Federal Reserve's continued interest rate cuts later this year. The US dollar index fluctuates downward, and as of now, the US dollar is priced at 97.94.

Overview of fundamentals of the foreign exchange market

The annual rate of the core PCE price index in August was 2.9%, which remained unchanged from the previous month and was in line with market expectations.

Richmond Fed Chairman Barkin: The upcoming data will determine whether the Fed should cut interest rates further; Federal Reserve Director Bowman strongly supports the Fed's only holdings of Treasury bonds, and it is appropriate to ignore the one-time impact of tariffs.

Trump: If the government has to shut down, then shut down. The economy is doing well and prices are falling; it is reported that Trump will meet with four congressional leaders on Monday, and Trump will attend a meeting with senior U.S. generals on Tuesday.

People familiar with the matter: The Trump administration considers imposing tariffs on foreign electronic devices based on the number of chips in each device, and also considers requiring chip xn--xm-6d1dw86k.companies to have local manufacturing capacity xn--xm-6d1dw86k.comparable to their customers' overseas imports. If the xn--xm-6d1dw86k.company cannot maintain a 1:1 ratio for a long time, it will face additional obstacles.Tax.

U.S. Vice President Vance said the United States is considering providing the Tomahawk missile to Ukraine.

Source said Hamas agreed to the US ceasefire proposal for Gaza, but Hamas said it had not received a new ceasefire proposal and the Palestinian-Israeli negotiations were deadlocked.

Iran rejected the United States' request to exchange all enriched uranium for a three-month "sanction period" on Iran; the United Nations confirmed that the sanctions resolution involving Iran has xn--xm-6d1dw86k.come into effect again, involving Iran's nuclear program, military industry and finance.

The White House will xn--xm-6d1dw86k.comply with the 15% limit on drug tariffs in its trade agreements with the EU and Japan. The UK may face 100% tariffs on drugs imported from the United States.

Summary of institutional views

Analyst DhwaniMehta: In order to start any meaningful rebound, pound-meter-US must effectively break through this convergence resistance zone

From the daily chart, pound-meter-US resumed its downward trend in the previous week after failing to maintain stability above the 21-day moving average many times. The US was blocked above the 21-day moving average, paving the way for a larger decline as it fell below the key 100-day and 50-day moving average support levels at 1.3487 and 1.3468 respectively. In the process, the US closed below the uptrend line support at 1.3462 last Wednesday. The selling momentum has since intensified, with the seller's target pointing to the 1.3300 mark. If the downward trend recovers, the 1.3300 integer mark will provide initial support, and after falling below it, it may test the August 4 low of 1.3254. Further below, the August low of 1.3142 may provide support for buyers. If it is lost, it may fall below the 200-day moving average at 1.3127. The RSI is still well below the midline, which makes the bearish potential of the pair still exist.

To open any meaningful rebound, the US must effectively break through the converged resistance zone at about 1.3475, which is the intersection of the 50-day moving average, the 100-day moving average and the uptrend line that has been converted into resistance. The subsequent related resistance above is located at the 21-day moving average (currently at 1.3509), followed by the 1.3600-1.3620 supply area. If you continue to break through the latter, you will test the July 4 high of 1.3681 on the way to 1.3788 (the high on July 1).

Nomura: USD/JPY volatility may increase due to upcoming data and events

Nomura Securities' global forex strategy said in a report that USD/JPY volatility may rise during the busy week of data and events in Japan and the United States. In Japan, the focus will be on a short-term survey by the Bank of Japan on Wednesday, which could show moderate improvement in manufacturing confidence and maintain expectations of rate hikes. The outside world will closely monitor speeches including those of the Bank of Japan officials to determine whether the Bank of Japan's assessment of the economy and inflation will change. In the U.S., they added that markets are looking at whether Congress will pass a ongoing resolution by Tuesday’s deadline to avoid a government shutdown. Nomura Securities expects USD/JPY to be 146.50-1 this week51.50 range fluctuations.

Analyst Adam Button: This week's non-farm report is "mine-ridden", with the core focus on...

Trump fired the head of the U.S. Bureau of Labor Statistics after a weak jobs report was released, which has sounded a major alarm for the quality of future economic data. However, the current problems facing non-farm employment data are much more than that.

The new report to be released next Friday can be described as "mine-covered". For traders, the biggest problem at the moment is how to consider the impact of immigration factors. There is good reason to believe that the sharp decline in the number of immigrants in the United States, coupled with spontaneous departures and mandatory repatriation, is having a substantial impact on the labor market. Although this impact is extremely difficult to quantify, Fed official Barkin said this week that he expects 00,000 to 50,000 new jobs per month to be the benchmark for the labor market to be stable - a sharp contrast to the 100,000 to 150,000 monthly level in the post-pandemic period.

This change will bring about a series of chain reactions. But for traders, I think the biggest risk is overreacting to near-zero growth employment data. On the surface, such data may appear weak, but the unemployment rate may remain stable. Because of this, I think traders should double down on unemployment data and ignore short-term fluctuations in the total number of non-farm jobs.

In addition, I am worried that the Fed may overreact to the downturn overall data and lower interest rates too low. This approach may lay hidden dangers for future inflation shocks or asset bubbles.

Citi's forward-looking non-agricultural industry: Are data rebounds all seasonally causing "chaos"?

Non-agricultural population: 105,000; unemployment rate: 4.3%

Our basic view on the US labor market remains that labor demand continues to weaken, which means that the unemployment rate will at least gradually increase, employment growth will slow down significantly, and the risk of further weakening of the labor market (such as layoffs) will also increase. However, after the data weakened significantly for 3-4 consecutive months, making these downside risks more obvious, we expect strong job growth in September, with an increase of 105,000. The unemployment rate should be maintained at 4.3%, but there are also dual risks. Importantly, this will reflect more favorable seasonal factors than stronger demand. We believe that a slight improvement in employment data for just one month is not enough to prevent the Fed from cutting interest rates again in October. Data after the Fed meeting in October may weaken sharply again, and we still expect weak fundamentals to lead to an increase in unemployment at the end of the year and lead to another rate cut in the Fed in the next four meetings.

The above content is all about "[XM Forex Official Website]: Inflation is stable and interest rate cuts, and the fate of the US dollar is dependent on employment data". It is carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Only the strong know how to fight; the weak are not qualified to fail, but are born to be conquered. Learn moreLet’s have a content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here