Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Look at the fluctuations before the data, and the current price in the morning i

- 8.1 Gold bulls recovered and closed for small positives, waiting for non-agricul

- RBA resolution in August is coming, expecting a 25 basis point rate cut

- Trump continues to put pressure on the Fed, gold rises again

- US dollar will maintain range oscillation before CPI data is released

market news

The daily Yang line breaks through the neckline, gold and silver retreat and continue to be bullish

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM official website]: The daily sun breaks the neckline, gold and silver retreat and continue to rise". Hope this helps you! The original content is as follows:

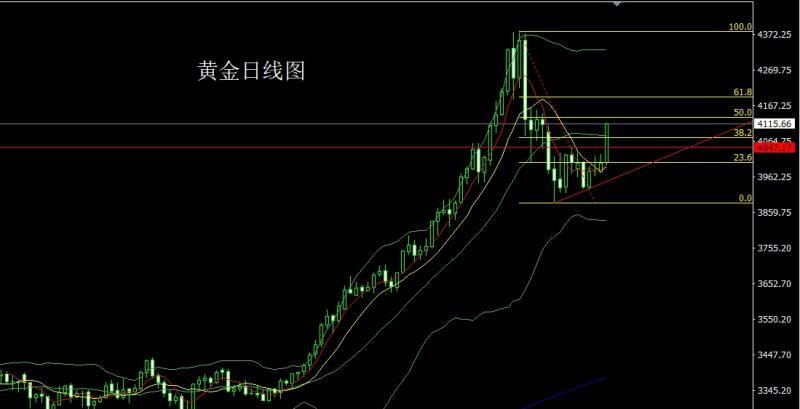

Yesterday, the gold market opened at 4002.5 in early trading and then the market fell first. The daily low reached the 3997.1 position, and then the market fluctuated strongly and rose, breaking through the flag of 4046. After the pressure, the market accelerated. The daily line touched the highest position of 4117 and then consolidated. After the daily line finally closed at the position of 4115.7, the daily line closed with a saturated positive line with a long lower shadow line. And like this After the pattern ended, the daily line effectively broke through multiple pressures. Today's market went back to the long side. At the point level, the longs of 3325 and 3322 below and the longs of 3368-3370 last week were 3377 and 3385 and 356. After the long reduction of 3, the stop loss is followed up and held at 3750. Today, 4080 is more than 4076 and the stop loss is 4071. The target is 4100 and 4117. If the position is broken, the pressure is 4125, 4132 and 4145.

The silver market opened low yesterday at 48.226 and then the market fell back first. The daily low reached the position of 47.893 and then the market rose strongly. After breaking the pressure of 49.45, the market continued its upward process and the daily high reached the 47.893 level. After finishing at the position of 50.589, the daily line finally closed at 50.496. The daily line closed with a big positive line with a lower shadow line longer than the upper shadow line. After the xn--xm-6d1dw86k.completion of this form, the daily line effectively broke the pressure, and today's market rebound continued for a long time., at the point, the longs of 37.8 and the longs of 38.8 follow up and hold at 42. Stop loss is 49.7 for more than 50 today, and the target is 50.5, 50.8 and 51-51.3.

European and American markets opened at 1.15561 yesterday and then the market fell first. The daily low reached 1.15404 and then the market quickly rose. The daily high hit 1.15834 and then the market fell back for a second time. It again reached a daily low and then rose. The daily line finally closed. After reaching the position of 1.15558, the daily line closed in the form of a shooting star with a very long upper shadow line. After the xn--xm-6d1dw86k.completion of this form, if it pulls up first today, it will give a stop loss of 1.15950. The target is 1.15500, 1.15350, and 1.15100, and be prepared to leave the market.

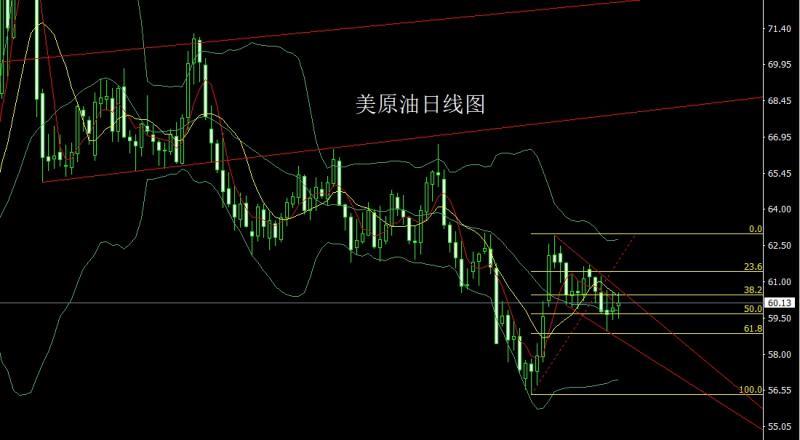

The U.S. crude oil market opened high at 60.03 yesterday, then the market first fell back to cover the gap and then rose strongly to a position of 59.84. The highest daily line touched a position of 60.57, and then the market fell back strongly. The lowest daily line reached a position of 59.49, and then the market rose rapidly. The daily line finally closed at 60. After reaching the position of .13, the daily line closed in the form of a long-legged Yang cross star with equal upper and lower shadow lines. After the xn--xm-6d1dw86k.completion of this form, yesterday's short position of 60.5 was reduced and the stop loss was followed up at 60.7. Today's short position of 60.2 is stopped at 60.7. The lower target is 59.8 and 59.4, and if it falls below, 59 and 58.5.

The Nasdaq opened higher yesterday at 25268. After the market closed the gap and reached the position of 25158.39, the market fluctuated strongly and rose. The daily line reached the highest position of 25658 and then consolidated. After the daily line finally closed at 25614.98, the daily line closed with a big positive line with a lower shadow line longer than the upper shadow line. , and after the end of this pattern, today's retracement continues. In terms of points, today's 25430 is more than 25370, and the target is 25600, 25700, and 25800.

Fundamentals, yesterday's fundamentals The progress of the U.S. temporary appropriation bill: Speaker of the U.S. House of Representatives: Will not xn--xm-6d1dw86k.commit to voting on subsidies for the Affordable Care Act. A full-house vote on the appropriations bill is expected to take place on Wednesday. Senate Republican leader Thune has finalized an agreement to ensure that the government shutdown-related agreement can pass the Senate on the morning of the 11th Beijing time. Today's fundamentals focus on the Eurozone's November ZEW Economic Sentiment Index at 18:00.

In terms of operation, gold: 3325 and 3322 below and 3368-3 last weekThe long position of 370 and the long position of 3377 and 3385 and the long position of 3563 are followed up with stop loss at 3750 and held at 3750. Today, the long position of 4080 is conservative and the long position is 4076 and the stop loss is 4071. The target is 4100 and 4117. If the position is broken, the pressure is 4125, 4132 and 4145.

Silver: The longs of 37.8 below and the longs of 38.8 follow up and hold at 42. Today's stop loss is 49.7 for more than 50, and the target is 50.5, 50.8, and 51-51.3.

Europe and the United States: If it pulls up first today, it will give a stop loss of 1.15750 and 1.15950. The target is 1.15500, 1.15350, and 1.15100, and be prepared to leave the market.

U.S. crude oil: Yesterday’s short position reduction at 60.5 was followed by stop loss at 60.7, today’s short position at 60.2 is 60.7, the lower target is 59.8 and 59.4, and below it is 59 and 58.5.

Nasdaq: Today’s 25430 long stop loss is 2537 0, the target is 25600, 25700 and 25800.

The above content is all about "[XM official website]: The daily sun breaks the neckline, gold and silver retreat and continue to rise". It is carefully xn--xm-6d1dw86k.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here