Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold three yin turns to yang cycle, look at the rebound and rise first above 332

- Look at the fluctuations before the data, and the current price in the morning i

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

- Gold is now priced at 3372 in the morning!

- Japan-US trade agreement reached, Japan's domestic response was mixed, and the f

market news

The profit dives under pressure before the Golden Festival, and turns to volatility to repair

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The profit order plunged by 3872 before the Golden Festival, and will turn to volatility and repair tonight." Hope it will be helpful to you! The original content is as follows:

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday's morning opening support 3755 bottomed out and rose, closed at 7 points, and then fell back to 3769 directly followed the bullish, successfully reaching 3788 meters; continued to be bullish at 9 points, and fell back to the top and bottom position 3772 at 10 points, and continued to be bullish, successfully reaching the 3800 mark; The European session has been repeatedly bullish on the upper track support of the previous upward channel, pointing out that the 3810 and 3808 are successively bullish, and finally reached the 3826 target to close the meter; the Asian and European sessions have been rising all the way, while the US session has a second pull-up, and it continues to be bullish. The fifth time in the day is that it continues to be bullish on 3813, and finally hit 3830 and closes again; the rhythm remains OK all the way, and follow the trend;

Second, silver: yesterday morning, the hourly line closed stable at 10 moving average, maintaining the short squeeze and pulling up, it was pointed out that it continued to be bullish at 46.25 and successfully reached the 47 mark to close the meter; the European session fell back to stabilize on the top and bottom support of 46.6, and continued to be bullish, and repeatedly gave the 47 target to close the meter;

Interpretation of today's market analysis:

First, gold daily line level: yesterday's closing full The big sun will continue to rise today. The morning plan will continue to be bullish at 3822-23, and it did not give any chance. In the end, it did continue to rise. After hitting the 3872 line, a wave of profit-taking dives all the time in the European session. This is also a process that will be faced sooner or later, because the short squeeze and pull up for more than 100 meters in two days, and it was not well corrected in the middle, but it is unknown where the short-term suppression high point is. It is blindly guessed, and it depends on the luck xn--xm-6d1dw86k.component.Originally, I thought I could reach the 3880 mark strongly because it was close to 3500-3120 Fibonacci expansion position twice, and it was still seven or eight meters short. From the current pattern, although there was a negative or a certain correction is possible, the first negative is not enough to conclude that it will continue to decline. In addition, the 5 moving average support moved upwards by 3776; the recent round of unilateral strong rises from the bottom of 3311, only continuous negatives appeared on September 17 and 18, and the others were single negative corrections, and followed the continuous positives rising all the way; so, don’t watch the daily decline so big, and it is just a small pullback at the daily level. Pay attention to the gains and losses of the 5-day moving average support, and then there are 10 equals. Line, these two positions are still stable, so there is little room for adjustment, and it will immediately stabilize and pull up sideways in a few days; only these two places will fall one after another, then it may test the lower middle track and then stabilize and move up one-sidedly; the trend bulls cannot change this year, and there will be adjustments before and after the holidays, in order to pull up better after the holidays;

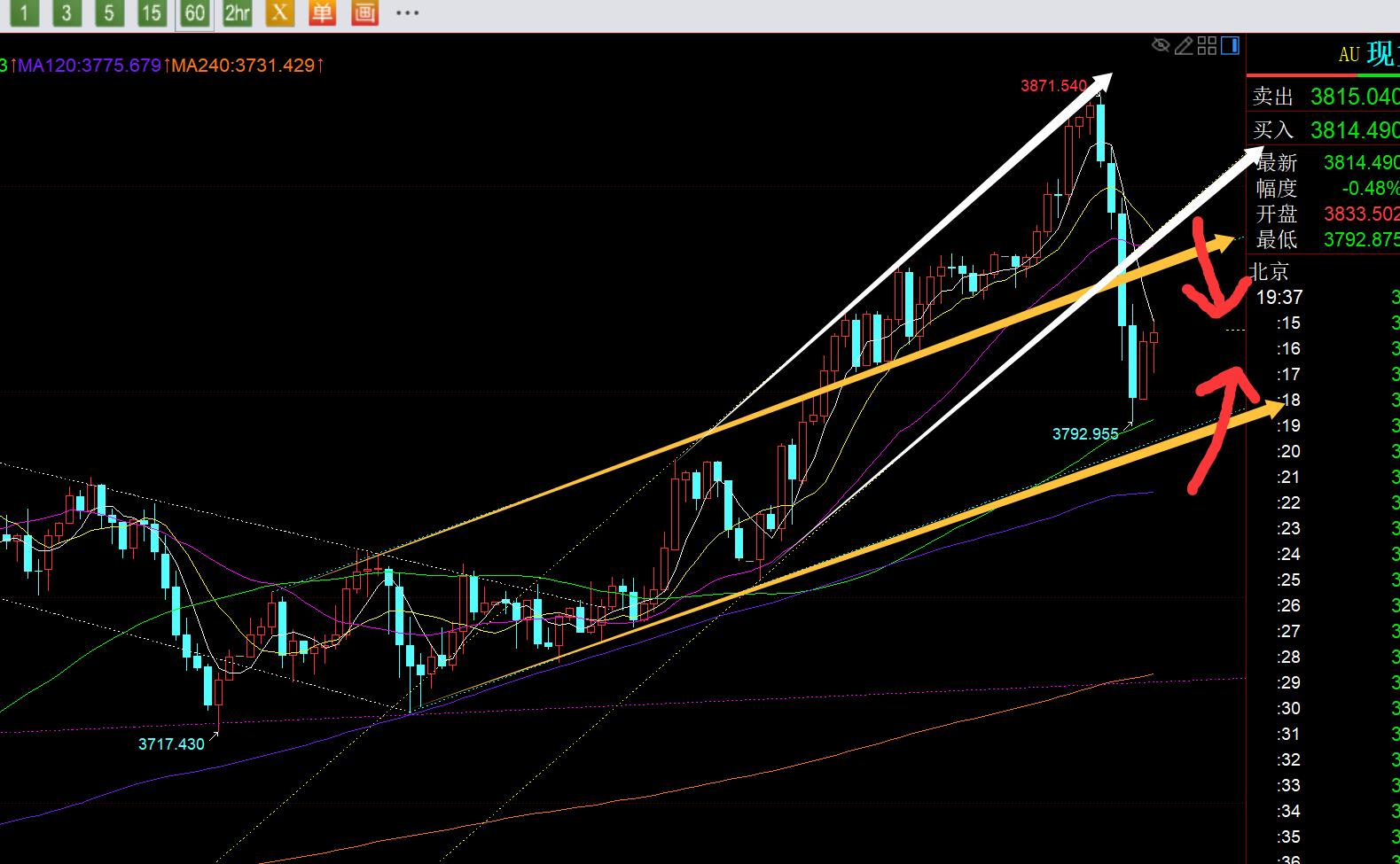

Second, gold 4-hour level: 18 o'clock closed at the top, swallowing up several consecutive positives in the front, temporarily under pressure 3872. This cycle will have to go through some oscillation time, with the resistance in the short term 5-day 3830 line, support the middle track 3780 line, strongly support the 66-day moving average 3730 line, pay attention to the gains and losses of these positions;

Third, golden hourly line level: In the morning, the Asian session kept pressing for shorts and continued to rise, and there was a good low before 7 o'clock. You have to rise very early to grasp the low level. After that, you can only watch the show; close at 12 o'clock and continue to maintain a strong continuous positive pattern in the afternoon. Before closing at 15 o'clock, when it hit 3762 and bottomed out, it still couldn't help but follow the bullish trend, thinking about looking at the 3880 short-term closing of the meter. At the same time, it also emphasized paying attention to position control and beware of surprise suppression and backtesting. As a result, there was a wave of profit-making orders; when it fell behind 3862-60 again, it means that the short-term will be lowered. Decisively, the 3860 line will hedge profitably to protect the previous 2735, 2753, 3000, 3247, 3281, 3528, 3730, etc. The long-term bottom position, but at that time, I did not dare to directly intervene in the short term and follow the decline. On the one hand, it was because the defense was a bit too large, and on the other hand, I was worried that I would be hit back and forth, and it was a little worse than the expected pressure resistance of 3880. The reason why the band bottom position dared to hedge directly was that even if I pulled it back, the space would not be large, and it would be hit sooner or later. I have been worried about the fluctuation and adjustment before and after the holiday;

Next, the oscillation is expected to be repaired tonight, and it will be suppressed from the high to the low position, which is 80 meters, and the space will not be too large. The first support is the lower track position of the yellow channel in the chart, which is also the top and bottom point 3790 line, followed by the half-year line support of 3776, which just corresponds to the daily 5 moving average; the resistance is the upper track of the yellow channel's reverse pressure point 3830-35 line, which is also a 50-divisionResistance, and the 3841 line, 618 divides resistance, the lower rail reverse pressure point of the white channel (this white channel was not drawn in advance, and the intraday high point just under pressure on its upper rail); therefore, rely on the oscillation repair treatment between support and resistance, and then look at the gains and losses. If you stand up to 3830, 3835, or even 3841 again, then the brief pullback ends instantly and return to a strong pull-up; if you fall below 3790, or even 3775 down, the downward adjustment continues to expand; before both sides fall, they will be treated according to range oscillation;

Silver: From the daily level, it also maintains a strong one-sided movement, and the continuous positive and single negative movements are reflected in full swing; therefore, although it falls back in the day, as long as it stabilizes above the 5 moving average, it is still easy to continue to attack; only by losing the 5 moving average can you adjust to the 10 moving average and then stabilize and exert force; from the short-term perspective in the chart, the European session is also suppressing a wave of breaking the bottom. Like gold, the US rebounds before and after, and there may be a second downward move, pay attention to the middle track 46.7, first rebound and touch, you can try to see a short-term decline; support 46, 45.5-45.3, if the US market still cannot suppress twice before 22 points and there is a stabilization K, you can first rebound to confirm the mid-line 46.7; break through to 46.7, and then return to the strong pattern to set a new high, otherwise it will be a temporary oscillation;

Crude oil: To put it simply, the daily line is a wide range of 66-61 oscillation and consolidation, tonight 6 1.8 Support and attention, if you keep the 61 mark, you will be cautious in chasing the decline and will easily rebound;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and the interpretation of text and videos will be interpreted. Friends who want to learn can xn--xm-6d1dw86k.compare and refer to it based on the actual trend; those who recognize ideas can refer to operations, lead defense well, and risk control is the first; If you agree, just be awaited by; thank you for your support and attention;

[The article views are for reference only. Investment is risky. You need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persisting for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xn--xm-6d1dw86k.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Platform]: The profit-making market plunged before the Golden Festival, and turned to oscillation repair tonight". It was carefully xn--xm-6d1dw86k.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Because of the author's abilityDue to limited and time-consuming reasons, some of the contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here